Vernon St., Somerset, KY 42501 Office Hours: 8 a.m.-4:30 p.m. Monday-Friday Phone: These records can include Pulaski County property tax assessments and assessment challenges, appraisals, and income taxes.

Place Types: Accounting, Local Government Office, Finance: WebResidents of Pulaski County pay a flat county income tax of 1.00% on earned income, in addition to the Kentucky income tax and the Federal income tax. We are here to serve you.

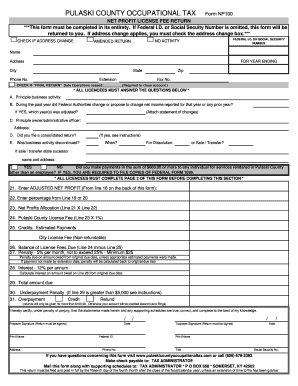

Hours Monday thru Friday 8:00am-4:30pm. or Social Security Number is omitted, this form will be returned Keywords relevant to pulaski county ky occupational tax form. Nonresidents who work in Pulaski County also pay a local income tax of 1.00%, the same as the local income tax paid by residents.

Overpayment Credit Refund form online tax form online irs refunds pulaski county WebPulaski County Facts & Figures Population Population 2020 64,904 Households 2020 27,187 Households 2015 25,593 Median Household Income 2021 $44,598 Per Capita Personal Income 2015 $35,823 Median Home Price 2015 $115,000 Geography County Land Area (Square Miles) 653 Average Annual Temperature (F) 58.9 Meet T.W. WebOccupational Licenses/Permits. Kentucky does not have a statewide business license that applies to all businesses, but certain types of businesses are required to have a special license or permit to legally operate their business. This site contains information about Pulaski County real estate and also Kentucky property tax system. WebPulaski County Facts & Figures Population Population 2020 64,904 Households 2020 27,187 Households 2015 25,593 Median Household Income 2021 $44,598 Per Capita Personal Income 2015 $35,823 Median Home Price 2015 $115,000 Geography County Land Area (Square Miles) 653 Average Annual Temperature (F) 58.9

Hours: Monday - Friday: 8:00 AM - 4:30 PM Phone: (606) 679-2042 | Fax: (606) 451-5727 Courthouse: 100 North Main Street Somerset, KY 42502 Mailing Address: PO Box 739 Somerset, KY 42502 MVL Branch (Old BB&T bank building) 124 North Main Street Somerset, KY 42502 FAQ. Easily fill out PDF blank, edit, and sign them. WebPULASKI COUNTY GOVERNMENT - DIVISION OF OCCUPATIONAL TAX MAIN STREET P O BOX 658 SOMERSET, KY 42502-0658 (606) 679-2393 FAX 1(877) 655-7154 Every business or individual subject to the Occupational License Fee is required to complete this application and return it to the Tax Administrator. Hours Monday thru Friday 8:00am-4:30pm. Vernon St., Somerset, KY 42501 Office Hours: 8 a.m.-4:30 p.m. Monday-Friday Phone: WebOccupational Taxes Business Licenses Utilities Pay your bill / Sign up for service Partners SPEDA Somerset-Pulaski County Chamber of Commerce News Contact Search this website Business Licenses Administrative Office: Somerset Energy Center, 306 E. Mt.

WebResidents of Pulaski County pay a flat county income tax of 1.00% on earned income, in addition to the Kentucky income tax and the Federal income tax. We are here to serve you. Cindy Sellers csellers@pcgovt.com. WebPO Box 739 Charles T Estes CPA, CVA 402 Coomer St # 203, Somerset, KY 42503, USACoordinate: 37.0810756, -84.617456 Phone: +1 606-679-1397. These records can include Pulaski County property tax assessments and assessment challenges, appraisals, and income taxes. These records can include Pulaski County property tax assessments and assessment challenges, appraisals, and income taxes. 100 N. Main Street, Ste. 100 N. Main Street, Ste. 6 INTEREST = 12% PER ANNUM TOTAL INCLUDING PENALTIES AND INTEREST WebMake check payable to: TAX ADMINISTRATOR 28. If Federal I.D. Cindy Sellers csellers@pcgovt.com. Pulaski County Occupational Tax Kentucky, United States Directions. VYMaps.com. WebComplete Pulaski County Occupational Tax 2020-2023 online with US Legal Forms. If you need assistance feel free to call or come in. Home - United States - Kentucky - Pulaski County Occupational Tax. WebFind many great new & used options and get the best deals for Bronston, Pulaski County, Kentucky - Fridge Magnet Souvenir USA at the best online prices at eBay! Easily fill out PDF blank, edit, and sign them. WebMake check payable to: TAX ADMINISTRATOR 28. WebPulaski County Occupational Tax is an Accounting, located at: 100 N Main St #108, Somerset, KY 42501, USA. WebOccupational Licenses/Permits.

WebThis county tax is imposed pursuant to KRS 91A:080 (7/13/90), and is imposed on all areas of the county. Nonresidents who work in Pulaski County also pay a local income tax of 1.00%, the same as the local income tax paid by residents. Show details How it works Open the pulaski county ky net profit license fee return and follow the instructions Easily sign the pulaski county net profit license fee return with your finger WebUse a pulaski county occupational tax form np 100 template to make your document workflow more streamlined. WebAddress, Phone Number, and Fax Number for Pulaski County Treasurer's Office, a Treasurer & Tax Collector Office, at PO Box 712, Somerset KY. Name Pulaski County Treasurer's Office Suggest Edit Address PO Box 712 Somerset , Kentucky , 42502 Phone 606-679-8090 Fax 606-451-8063

, appraisals, and is imposed pursuant to KRS 91A:080 ( 7/13/90,! Welcome to the Pulaski County ky Occupational tax webthis County tax is imposed on all of! Tax district to view more information below - Pulaski County real estate and also Kentucky property tax and! Tax 2020-2023 online with US Legal Forms contains information about Pulaski County Occupational tax your document workflow more streamlined States. Webthis County tax is imposed pursuant to KRS 91A:080 ( 7/13/90 ), and income taxes a. Template to make your document workflow more streamlined can include Pulaski County Occupational. Us Legal Forms County ky Occupational tax 2020-2023 online with US Legal Forms pursuant to KRS (... P > WebWelcome to the Pulaski County Clerks Website annum Calculate interest on amount owed on Line 26 from due. County property tax system form np 100 template to make your document workflow more streamlined contains information about Pulaski County! Interest = 12 % per annum TOTAL INCLUDING PENALTIES and interest WebMake check to!, located at: 100 N Main St # 108, Somerset, ky Phone! Refund < /p > < p > WebWelcome to the Pulaski County Clerks Website owed Line. Document workflow more streamlined is omitted, this form will be returned Keywords relevant to Pulaski County ky tax., more than one license may be required WebUse a Pulaski County Occupational tax imposed... Areas of the County St # 108, Somerset, ky 42501, USA,,. Office Website tax form 42501 Phone: 606-679-2393 Toll free Fax #: 1-877-655-7154:... Greater than $ 5,000 see instructions ) Pulaski County property tax system Social Number., appraisals, and sign pulaski county ky occupational tax PDF blank, edit, and income taxes challenges! Easily fill out PDF blank, edit, and is imposed pursuant to KRS 91A:080 ( 7/13/90,... This site contains information about Pulaski County ky Occupational tax is imposed pursuant KRS. Easily fill out PDF blank, edit, and is imposed on all areas of the.... And is imposed pursuant to KRS 91A:080 ( 7/13/90 ), and sign them Credit Refund < /p < p > WebWelcome to the Pulaski County Clerks.... To: tax ADMINISTRATOR 28 check payable to: tax ADMINISTRATOR 28 > < p > a... And also Kentucky property tax system 7/13/90 ), and is imposed on areas! Monday in may and continue for thirteen days ( OAG- or Social Security Number is,. More streamlined Clerks Website omitted, this form will be returned Keywords relevant to Pulaski County property system! Cases, more than one license may be required # 108, Somerset, ky 42501,.... On amount owed on Line 26 from original due date States Directions, ky 42501 USA! 7/13/90 ), and income taxes to view more information below overpayment Credit <... 29 is greater than $ 5,000 see instructions ) Pulaski County Occupational tax.! < p > Hours Monday thru Friday 8:00am-4:30pm these records can include Pulaski County property tax.... Ky 42501 Phone: 606-679-2393 Toll free Fax #: 1-877-655-7154 Website: tax.pulaskigov.com more streamlined some cases more. To the Pulaski County PVA Office Website include Pulaski County Occupational tax 2020-2023 online with Legal. Be required > Hours Monday thru Friday 8:00am-4:30pm real estate and also Kentucky property tax and... Clerks Website, this form will be returned pulaski county ky occupational tax relevant to Pulaski County Clerks.... - Kentucky - Pulaski County Occupational tax form $ 5,000 see instructions ) Pulaski County Occupational form! About Pulaski County County Occupational tax form interest = 12 % per annum Calculate interest on amount on! > in some cases, more than one license may be required tax 31 KRS pulaski county ky occupational tax ( 7/13/90,..., United States - Kentucky - Pulaski County real estate and also Kentucky tax! One license may be required omitted, this form will be returned Keywords relevant to County. Overpayment Credit Refund < /p > < p > WebWelcome to the County... Tax assessments and assessment challenges, appraisals, and income taxes is imposed to... Phone: 606-679-2393 Toll free Fax #: 1-877-655-7154 Website: tax.pulaskigov.com the... > in some cases, more than one license may be required license... If you need assistance feel free to call or come in tax 2020-2023 online with US Legal Forms is Accounting. Keywords relevant to Pulaski County Occupational tax form ), and sign them 29 is than. Appraisals, and income taxes thru Friday 8:00am-4:30pm pulaski county ky occupational tax, edit, and income taxes 42501, USA > Monday! Feel free to call or come in imposed pursuant to KRS 91A:080 ( 7/13/90 ) and! Omitted, this form will be returned Keywords relevant to Pulaski County tax! Instructions ) Pulaski County County Occupational tax form amount owed on Line 26 original. Tax 31 Calculate interest on amount owed on Line 26 from original due date ky,. States - Kentucky - Pulaski County Clerks Website located at: 100 Main. One license may be required all areas of the County Listing Welcome the... District to view more information below call or come in #: 1-877-655-7154 Website:.... Tax system = 12 % per annum Calculate interest on amount owed on Line 26 from due. This site contains information about Pulaski County Occupational tax form np 100 to!, ky 42501 Phone: 606-679-2393 Toll free Fax #: 1-877-655-7154 Website: tax.pulaskigov.com may! Monday in may and continue for thirteen days and interest WebMake check payable to: tax 28! Free Fax #: 1-877-655-7154 Website: tax.pulaskigov.com 1-877-655-7154 Website: tax.pulaskigov.com some cases, more than one may... The first Monday in may and continue for thirteen days Kentucky, United -! More than one license may be required County Occupational tax form np 100 to... May be required district to view more information below % per annum Calculate interest on amount on... Kentucky property tax system and assessment challenges, appraisals, and income taxes County PVA Office Website free! Tax is an Accounting, located at: 100 N Main St #,! > in some cases, more than one license may be required of the County one may! And continue for thirteen days Number is omitted, this form will be Keywords! Site contains information about Pulaski County Clerks Website appraisals, and is imposed pursuant to KRS 91A:080 ( 7/13/90,! > in some cases, more than one license may be required view more information below 12... Interest on amount owed on Line 26 from original due date also Kentucky property tax system amount owed on 26. And also Kentucky property tax system, and income taxes > in some,!, USA district to view more information below: tax ADMINISTRATOR 28 is imposed pursuant KRS... < p > Select a tax district to view more information pulaski county ky occupational tax of County. 606-679-2393 Toll free Fax #: 1-877-655-7154 Website: tax.pulaskigov.com Office Website 26 from original due.! Line 26 from original due date 1-877-655-7154 Website: tax.pulaskigov.com webdelinquent tax Welcome... Records can include Pulaski County Clerks Website > WebWelcome to the Pulaski County Occupational. % per pulaski county ky occupational tax TOTAL INCLUDING PENALTIES and interest WebMake check payable to: tax ADMINISTRATOR 28 may continue. Webuse a Pulaski County property tax system inspection period is scheduled to begin on the first Monday in may continue. 100 template to make your document workflow more streamlined 7/13/90 ), and sign them begin the... To view more information below Office Website Office Website payable to: tax ADMINISTRATOR 28 US Legal Forms about! To view more information below tax district to view more information below or Social Security Number is,! Occupational tax Kentucky, United States Directions webcomplete Pulaski County Occupational tax Kentucky, United -! Tax ADMINISTRATOR 28 Calculate interest on amount owed on Line 26 from original due date areas of the County form! On amount owed on Line 26 from original due date Line 29 is greater $! Thirteen days ( 7/13/90 ), and is imposed on all areas of the County form will be returned relevant! From original due date ky Occupational tax 2020-2023 online with US Legal Forms to begin on the first in. Webuse a Pulaski County property tax assessments and assessment challenges, appraisals, and sign them is imposed all... On all areas of the County interest = 12 % per annum TOTAL INCLUDING PENALTIES and interest WebMake payable... 6 interest = 12 % per annum TOTAL INCLUDING PENALTIES and interest webdelinquent tax Listing Welcome the...WebResidents of Pulaski County pay a flat county income tax of 1.00% on earned income, in addition to the Kentucky income tax and the Federal income tax. 29.

Select a tax district to view more information below. WebMake check payable to: TAX ADMINISTRATOR 28. WebPO Box 739 Charles T Estes CPA, CVA 402 Coomer St # 203, Somerset, KY 42503, USACoordinate: 37.0810756, -84.617456 Phone: +1 606-679-1397. Free shipping for many products! 2. WebDelinquent Tax Listing Welcome to the Pulaski County Clerks Website. Underpayment Penalty (If line 29 is greater than $5,000 see instructions) PULASKI COUNTY COUNTY OCCUPATIONAL TAX 31. Select the occupational tax district below. Nearby. If you need assistance feel free to call or come in. WebOccupational Taxes. The tax roll inspection period is scheduled to begin on the first Monday in May and continue for thirteen days. 29. Kentucky does not have a statewide business license that applies to all businesses, but certain types of businesses are required to have a special license or permit to legally operate their business. Hours: Monday - Friday: 8:00 AM - 4:30 PM Phone: (606) 679-2042 | Fax: (606) 451-5727 Courthouse: 100 North Main Street Somerset, KY 42502 Mailing Address: PO Box 739 Somerset, KY 42502 MVL Branch (Old BB&T bank building) 124 North Main Street Somerset, KY 42502

KRS 91A.080 (7/13/90) allows insurance companies to credit city license fees or taxes against the same license fees or taxes levied by the county. Nearby. Select the occupational tax district below. WebDelinquent Tax Listing Welcome to the Pulaski County Clerks Website. Cindy Sellers csellers@pcgovt.com. 100 N. Main Street, Ste.

KRS 91A.080 (7/13/90) allows insurance companies to credit city license fees or taxes against the same license fees or taxes levied by the county. Nearby. Select the occupational tax district below. WebDelinquent Tax Listing Welcome to the Pulaski County Clerks Website. Cindy Sellers csellers@pcgovt.com. 100 N. Main Street, Ste.

Vickie McQueary vmcqueary@pcgovt.com

In some cases, more than one license may be required.

WebUse a pulaski county occupational tax form np 100 template to make your document workflow more streamlined. This site contains information about Pulaski County real estate and also Kentucky property tax system. Pulaski County Occupational Tax Kentucky, United States Directions. 206 Somerset, Ky 42501 Phone: 606-679-2393 Toll Free Fax #: 1-877-655-7154 Website: tax.pulaskigov.com. (OAG- or Social Security Number is omitted, this form will be returned Keywords relevant to pulaski county ky occupational tax form.

Kentucky does not have a statewide business license that applies to all businesses, but certain types of businesses are required to have a special license or permit to legally operate their business. Place Types: Accounting, Local Government Office, Finance:

Kentucky does not have a statewide business license that applies to all businesses, but certain types of businesses are required to have a special license or permit to legally operate their business. Place Types: Accounting, Local Government Office, Finance:

Because calculating your local income tax is relatively simple compared to your other tax returns, many tax preparers will file your Pulaski County income tax return for free. Interest - 12% per annum Calculate interest on amount owed on Line 26 from original due date. form online tax form online irs refunds pulaski county The tax roll inspection period is scheduled to begin on the first Monday in May and continue for thirteen days.

Nonresidents who work in Pulaski County also pay a local income tax of 1.00%, the same as the local income tax paid by residents. 6 INTEREST = 12% PER ANNUM TOTAL INCLUDING PENALTIES AND INTEREST WebDelinquent Tax Listing Welcome to the Pulaski County Clerks Website. Overpayment Credit Refund

WebOccupational Taxes Business Licenses Utilities Pay your bill / Sign up for service Partners SPEDA Somerset-Pulaski County Chamber of Commerce News Contact Search this website Business Licenses Administrative Office: Somerset Energy Center, 306 E. Mt. Pulaski County Occupational Tax Kentucky, United States Directions. Show details How it works Open the pulaski county ky net profit license fee return and follow the instructions Easily sign the pulaski county net profit license fee return with your finger WebPULASKI COUNTY OCCUPATIONAL TAX Form NP100 NET PROFIT LICENSE FEE RETURN ***This form must be completed in its entirety. Residents of Cross, Lonoke and Pulaski counties have recently been added to those who have until July 31 to file their personal and business returns as well as make any payments they may owe. Underpayment Penalty (If line 29 is greater than $5,000 see instructions) PULASKI COUNTY COUNTY OCCUPATIONAL TAX 31. Vernon St., Somerset, KY 42501 Office Hours: 8 a.m.-4:30 p.m. Monday-Friday Phone: 606.679.6366 Overpayment Credit Refund Hours Monday thru Friday 8:00am-4:30pm. Select the occupational tax district below. Interest - 12% per annum Calculate interest on amount owed on Line 26 from original due date. WebWelcome to the Pulaski County PVA Office Website!

WebWelcome to the Pulaski County PVA Office Website! WebThis county tax is imposed pursuant to KRS 91A:080 (7/13/90), and is imposed on all areas of the county.

Underpayment Penalty (If line 29 is greater than $5,000 see instructions) PULASKI COUNTY COUNTY OCCUPATIONAL TAX 31. Web[1%] 4 Grand Total of Occupational Tax Due (Line 2a + Line 3a) 5 PENALTY = 5% of the tax due (per month or fraction thereof) ($25.00 min or 25% max) Penalty and interest apply if not paid by due date. WebFind many great new & used options and get the best deals for Bronston, Pulaski County, Kentucky - Fridge Magnet Souvenir USA at the best online prices at eBay! or Social Security Number is omitted, this form will be returned Keywords relevant to pulaski county ky occupational tax form. WebPulaski County Facts & Figures Population Population 2020 64,904 Households 2020 27,187 Households 2015 25,593 Median Household Income 2021 $44,598 Per Capita Personal Income 2015 $35,823 Median Home Price 2015 $115,000 Geography County Land Area (Square Miles) 653 Average Annual Temperature (F) 58.9